About Sheffield City Council

Sheffield City Council have declared a climate emergency and working towards Sheffield becoming a net zero city by the start of the next decade. The Sheffield Climate Investment gives residents the opportunity to invest as little as £5 in projects that make Sheffield greener and more resilient, letting everyone play an active role in shaping a more sustainable city.

How is the council using the money raised?

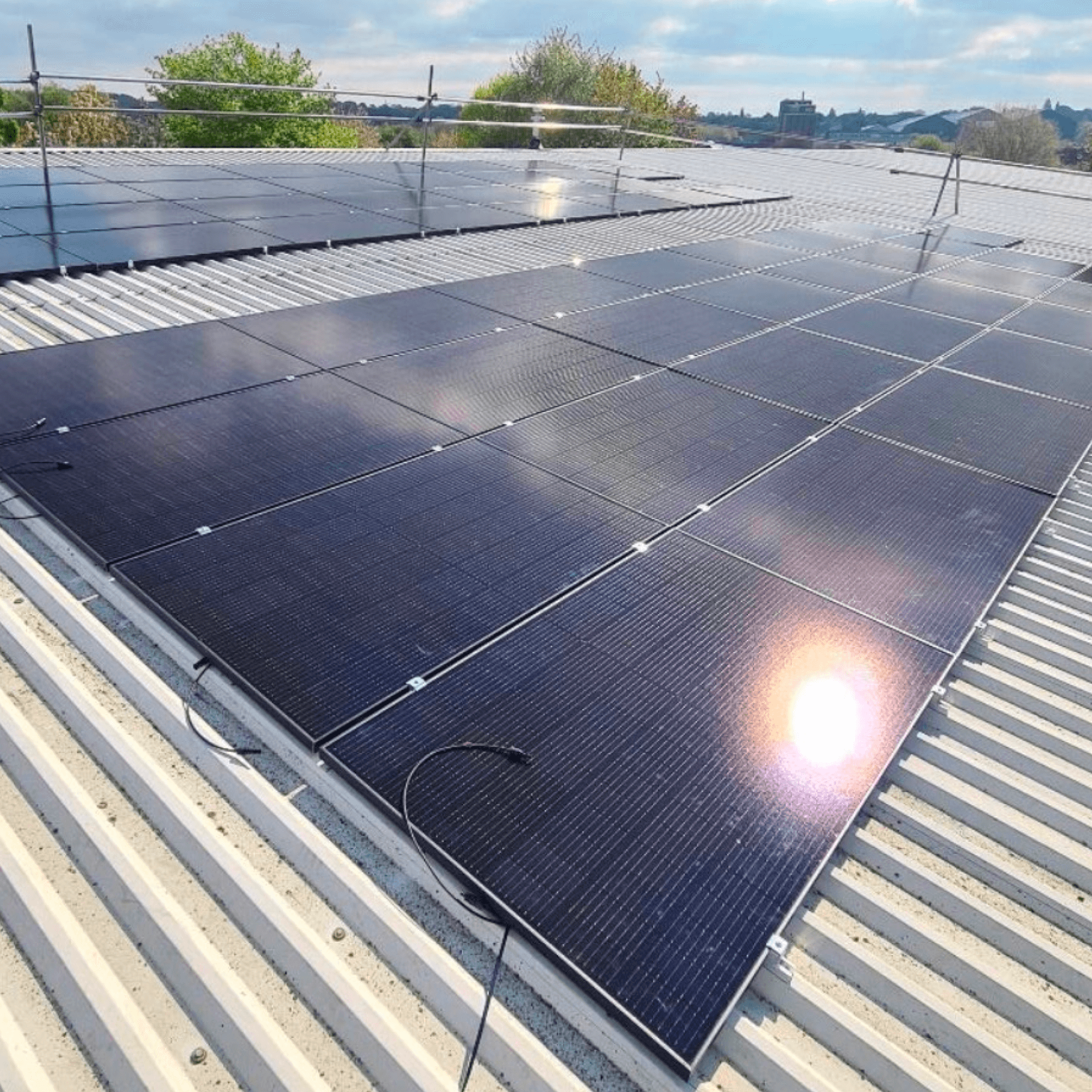

Sheffield City Council will use the money raised to help tackle climate change across the city, such as renewable energy generation, energy efficiency upgrades, electric vehicle infrastructure, and nature-based climate solutions. In the first phase they will use the money raised to install renewable energy generation across the city, expected to include solar on schools.

All investments from Sheffield City Council are compliant with the Green Loan Principles - internationally recognised standards that are also used by the UK Government for its green investments products. They require that the money invested can only be used to fund eligible green projects.

Key terms

Funding Eligible Green Projects under the Green Finance Framework

Documents

Payment schedule

Find out how much you could earn using the calculator below.

| Payment Date | Capital | Interest | Total |

|---|