What does the company do?

The Distributed Generation (DistGen) group, set up in 2005, owns and operates renewable wind energy projects in the UK. DistGen Rogershill was the second wind turbine project developed by the DistGen group and began generating renewable electricity in 2012.

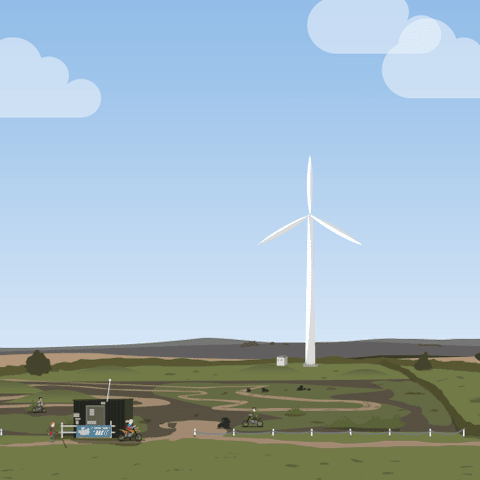

The wind turbine used for the DistGen Rogershill project underwent a complete refurbishment after having spent 17 years in the Sweden, before being installed at its new home near Bere Regis, Dorset in 2012. The wind turbine, a refurbished 500kW turbine, generates renewable electricity fed into the UK grid. The wind turbine is accredited for the Feed-in Tariff scheme, which pays a fixed amount (rising annually with inflation) for each unit of electricity generated, plus an additional amount for the electricity exported to the grid. The company can choose to opt out of the export Feed-in tariff and instead agree a contract with an energy supplier when wholesale electricity prices are higher.

The electricity produced pays investors a return while a portion of gross revenues go to the parish of Bere Regis. In the case of DistGen Rogershill, the aim is to donate 3% of annual revenues to the local community. In the past this has been used to support a number of schemes including a skate park, a NeighbourCar taxi service, and pathways to make the surrounding countryside more accessible.

Why did the company raise money?

This was DistGen’s first offer on Abundance. The money raised refinanced the original installation costs of the Rogershill wind project.

How does the company expect to repay the investment?

DistGen Rogershill expects to repay investors from revenues it earns over the life of the investment from the generation and sale of electricity from its wind turbine.

How is the company making an impact?

DistGen Rogershill is helping to increase the amount of renewable energy used in the UK’s electricity grid as we transition to a 100% low carbon energy future.

DistGen has created a scalable group of companies to localise and democratise energy provision. Alongside generating renewable energy, DistGen is also committed to delivering further benefits to communities by supporting social, welfare, cultural and/or sporting facilities, and where possible they offer a direct community contribution to encourage and sustain such local initiatives.

Key terms

Investment returns are paid every 6 months over the life of the investment.

The amount returned to investors in each period is linked to the performance of the company in the preceding 6 month period. In each period, the return paid goes first towards repaying an equal instalment of the original capital invested, and anything above that amount in each period will be paid as investment income.

The company can only make an early repayment of the investment in certain circumstances, such as a change of control of the company (for example, if some or all of the company was sold to a new owner) or a regulatory/tax requirement.

See the Debenture Deed for details of all circumstances in which the option for early repayment may be exercised.Documents

Payment schedule

This table gives a breakdown of what has been paid back to date on this investment, based on an example investment of £1,000. The return on this investment is linked to the performance of the project during each return period.

| Payment date | Capital repayment | Dividend | Total |

|---|---|---|---|

| 9 June 2015 | £27.78 | £47.59 | £75.37 |

| 9 December 2015 | £27.78 | £14.82 | £42.60 |

| 9 June 2016 | £27.78 | £68.66 | £96.44 |

| 9 December 2016 | £27.78 | £2.44 | £30.22 |

| 9 June 2017 | £27.78 | £21.36 | £49.14 |

| 8 December 2017 | £27.78 | £5.90 | £33.68 |

| 8 June 2018 | £27.78 | £47.31 | £75.09 |

| 7 December 2018 | £27.78 | £0.30 | £28.08 |

| 7 June 2019 | £27.78 | £27.60 | £55.38 |

| 9 December 2019 | £27.78 | £3.35 | £31.13 |

| 9 June 2020 | £27.78 | £45.36 | £73.14 |

| 9 December 2020 | £27.78 | £6.71 | £34.49 |

| 9 June 2021 | £27.78 | £41.71 | £69.49 |

| 9 December 2021 | £27.78 | £0.01 | £27.79 |

| 9 June 2022 | £27.78 | £25.75 | £53.53 |

| 9 December 2022 | £27.78 | £0.60 | £28.38 |

| 9 June 2023 | £27.78 | £44.28 | £72.06 |

| 8 December 2023 | £27.78 | £43.49 | £71.27 |

| 7 June 2024 | £27.78 | £93.89 | £121.66 |

| 9 December 2024 | £27.78 | £15.54 | £43.31 |

| 9 June 2025 | £27.78 | £25.98 | £53.75 |

| 9 December 2025 | £27.78 | £15.31 | £43.08 |

| 9 June 2026 | Variable | Variable | Variable |

| 9 December 2026 | Variable | Variable | Variable |

| 9 June 2027 | Variable | Variable | Variable |

| 9 December 2027 | Variable | Variable | Variable |

| 9 June 2028 | Variable | Variable | Variable |

| 8 December 2028 | Variable | Variable | Variable |

| 8 June 2029 | Variable | Variable | Variable |

| 7 December 2029 | Variable | Variable | Variable |

| 7 June 2030 | Variable | Variable | Variable |

| 9 December 2030 | Variable | Variable | Variable |

| 9 June 2031 | Variable | Variable | Variable |

| 9 December 2031 | Variable | Variable | Variable |

| 9 June 2032 | Variable | Variable | Variable |

| 9 December 2032 | Variable | Variable | Variable |