What does the company do?

Wenea is part of Diggia Group, a multinational group delivering engineering services in the areas of telecommunications, green energy and sustainable mobility. Diggia operate one of the largest Spanish electric vehicle (EV) charging networks, and has the technical experience to deliver a reliable and effective charging experience for drivers. Its UK division, based in Exeter and London, has built 80MW of UK solar power, and has an expanding EV charger division. Wenea provides operation and maintenance services for third party EV charging services, including GeniePoint, and has an increasing network of its own chargers.

Wenea wants to grow its charger business, and is specifically targeting partnerships with councils to rapidly deploy its charging network. Working with councils offers Wenea a number of advantages. It can align its business plans with key council priorities, enabling Wenea to quickly roll out a substantial and focused deployment of chargers in regions that are currently underserved, and take a market leading position in these areas. Councils will also use their communication channels to maximise charger utilisation, as well as providing other practical assistance.

Wenea has a track record of working with councils to install EV charging infrastructure and has operational chargers across the UK; including in Exeter and East Devon for Devon County Council, in Oxford as part of the council's recent Energy Superhub project. It has secured several contracts with councils to deliver public charger projects.

Why did the company raise money?

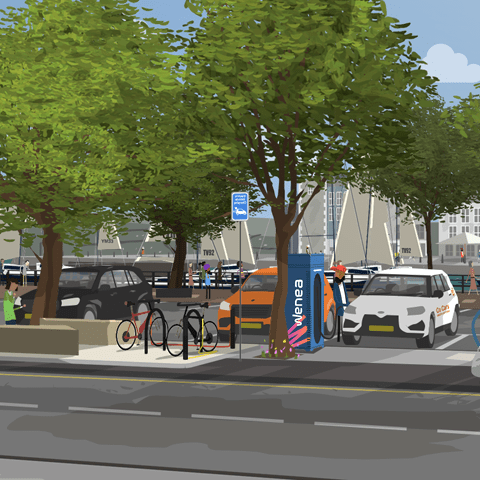

The company raised funding through Wenea Plymouth to fund the installation of EV chargers in partnership with Plymouth City Council.

Plymouth City Council has secured significant funding from the Department for Transport's Transforming Cities Fund to help transform how their residents get around their city. They plan to do this through a network of transport hubs – a key part of their integrated low carbon transport and regeneration strategy, and will connect areas with limited public transport and provide flexible transport options for residents.

The council are creating low carbon transport hubs across the city, which will include EV charging infrastructure and Co Cars (an EV car sharing club). This is solving a key problem as before the project began Plymouth only had 8 rapid public EV chargers in the city to serve a population of over 250,000. Plymouth City Council has chosen to partner with Wenea UK to deliver the EV charging infrastructure.

How does the company expect to repay the investment?

Wenea Plymouth expects to pay the interest and capital repayments owed to investors over the life of the investment through the revenues generated from the use of its electric vehicle chargers.

How is the company making an impact?

Wenea is helping to expand the UK's electric vehicle charging network which is critical to the adoption of more electric vehicles and cutting carbon emissions from the transport sector.

Key terms

Interest and capital is paid in instalments over the life of the investment. Interest periods are 6 months.

For the first two interest periods, to 31 December 2023 and 30 June 2024, no capital or interest is paid out and the interest is instead rolled up, and paid out across the following 4 periods which pay interest only. The unpaid rolled up interest will continue to earn interest at the same rate.

Capital repayments start from 31 December 2026 and all future periods then include both interest and capital is paid every 6 months.

This investment has first ranking security over all of the assets of Wenea Plymouth Limited under a package of security documents including:

- a security agreement by way of fixed and floating charge over all of the assets of Wenea Plymouth Limited

- a share charge granted by its parent company over all the issued share capital of Wenea Plymouth Limited

Wenea Mobile Energy SL (as the parent of the electric vehicle charger division within the Group) has provider a parent company guarantee of the interest and capital payments which means in the event that Wenea Plymouth is unable to do make those payments, Wenea Mobile Energy would have an obligation to make the payment due. It should be noted that this does not, however, count as security.

The company can make an early repayment any time after 30 June 2026, subject to paying an early redemption fee equivalent to 6-months interest and by giving 20 business days's notice.

The company can also make an early repayment in certain circumstances, such as a change of control of the company (for example, if some or all of the company was sold to a new owner) or a regulatory/tax requirement.

See the Debenture Deed for details of all circumstances in which the option for early repayment may be exercised. See the Debenture Deed for details of all circumstances in which the option for early repayment may be exercised.Documents

Payment schedule

This table gives a breakdown of what is due to be paid back on this investment, based on an example investment of £1,000.

| Payment date | Capital repayment | Interest | Total |

|---|---|---|---|

| 31 December 2024 | £0.00 | £45.36 | £45.36 |

| 30 June 2025 | £0.00 | £67.87 | £67.87 |

| 31 December 2025 | £0.00 | £73.98 | £73.98 |

| 30 June 2026 | £0.00 | £80.64 | £80.64 |

| 31 December 2026 | £22.94 | £64.96 | £87.90 |

| 30 June 2027 | £52.21 | £43.60 | £95.81 |

| 31 December 2027 | £62.48 | £41.96 | £104.44 |

| 30 June 2028 | £75.14 | £38.70 | £113.84 |

| 29 December 2028 | £88.37 | £35.71 | £124.08 |

| 29 June 2029 | £104.06 | £31.18 | £135.24 |

| 31 December 2029 | £120.44 | £26.98 | £147.42 |

| 28 June 2030 | £139.53 | £21.17 | £160.70 |

| 31 December 2030 | £159.97 | £15.19 | £175.16 |

| 30 June 2031 | £174.86 | £7.79 | £182.65 |

| Total | £1,000.00 | £595.09 | £1,595.09 |