What does the company do?

OneFarm is an owner and operator of a large-scale indoor vertical farm in Newmarket, Suffolk. The farm is built in an existing warehouse that has been renovated and fitted with solar panels. At the full target farm size, it will have the potential to supply 415 tonnes of vegetables a year. The intention is to roll out a portfolio of these large-scale indoor vertical farms across the UK. OneFarm is majority owned by OneFarm BV, a company based in the Netherlands and set up in 2016.

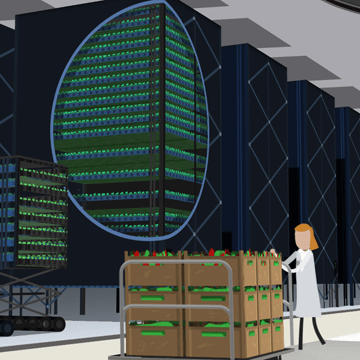

Indoor vertical farming is a type of controlled environment agriculture. There are different technologies used but the key principle is growing plants indoors in vertically stacked layers and using LED lighting. While vertical farms have higher energy requirements during the growth phase than traditional farming due to the need for artificial lighting, they have other benefits both economically and environmentally. The plants in the indoor vertical farm grow quickly because of the innovative technology used that optimises the light, particularly by selecting the optimal light spectrum, to give the plant exactly the energy it needs to grow. This means quicker growth cycles and consistent yields throughout the year, even in winter months. The indoor vertical farm is highly modular and automated and can be situated closer to where the demand is, cutting down on food miles.

The vertical farming technology for OneFarm’s farm is provided by Intelligent Growth Solutions and the farm uses renewable electricity to power its lighting. The growing system consists of distinct, individual and fully-automated growth towers. These are up to 9m tall and contain layers of growth trays. The growth trays provide the growing platform, hydroponics tray, ventilation and the growing lights in a single unit. The growth trays are arranged in an adjustable racking system and are moved around using an automated central lift mechanism and robotics for transfer from the growth tower to a central service area for picking, cleaning and maintenance. Each growth tray has individually controllable ventilation and irrigation.

The type of crops grown tend to be small and sensitive leaf vegetables, such as microgreens, herbs and leafy greens, that can be grown on thin growth trays and which benefit from a protected and controlled environment. The produce from the farm will predominantly be sold to to supermarket retailers and other larger demand customers such as catering and food service groups and home delivery recipe box providers.

Why did the company raise money?

The company raised funding on Abundance as part of a wider funding package to install its first indoor vertical farm in Newmarket. With the amount raised the company was able to install a total of 14 growth towers providing 5,400m2 of growing area plus related ancillary farm infrastructure. Funding was also provided by New Anglia Local Enterprise Partnership (working with Suffolk County Council), Intelligent Growth Solutions, Creditforce (a private investment company) and two of the company’s directors.

How does the company expect to repay the investment?

OneFarm expects to repay the investment in instalments using its profits from selling its produce.

How is the company making an impact?

The food industry accounts for over a quarter of global greenhouse gas emissions so it is a key sector in the climate challenge.

Vertical farms have a number of environmental benefits compared to traditional forms of farming, although they do have higher energy needs in the growth phase due to the need for artificial lighting. By farming indoors, a vertical farm can tightly control the growing environment and the inputs. This reduces the amount of fertiliser and water required and cuts out the need for pesticides, which means the produce does not need to be washed which extends its shelf life. Food can be grown much closer to the consumer, cutting down on transport emissions, and use significantly less land, freeing up land for other uses or re-wilding. With a more consistent growing environment and therefore crop yields, a vertical farm can also cut down on the waste from lost crops or produce that does not meet the needs of customers.

Key terms

The interest and capital is paid in equal instalments every 6 months (the first return is paid after a longer 18 month period to allow for the construction of the vertical farm).

This investment has security over all of the assets of OneFarm Limited under a package of security documents including:

- security agreements by way of fixed and floating charges over the assets of OneFarm Limited, except for certain Intelligent Growth Solutions equipment until paid for by and transferred to the ownership of OneFarm Limited under the lease purchase agreement;

- various direct agreements which provide the Security Trustee with certain rights such as being notified of a termination event or, in some cases, stepping into our shoes upon a termination event under certain project contracts (such as the lease purchase agreement and equipment supply agreement).

Suffolk County Council will also benefit from security over the assets of OneFarm Limited. Both the Suffolk County Council security and the Abundance security will rank pari-passu (i.e. they will share equally any available assets of OneFarm Limited, or any proceeds realisable from the sale of any of those assets subject to the Intelligent Growth Solutions lease purchase agreement) and this is governed by an Intercreditor Agreement between Abundance, Suffolk County Council, OneFarm Limited and the other funders.

The company has the option to repay the investment at any point from 1 May 2025 onwards subject to paying an early redemption fee (equivalent to the next 6 months's interest payment) and by giving 20 business days's notice.

The company can also make an early repayment in certain circumstances, such as a change of control of the company (for example, if some or all of the company was sold to a new owner) or a regulatory/tax requirement.

See the Debenture Deed for details of all circumstances in which the option for early repayment may be exercised.Documents

Payment schedule

This table gives a breakdown of what is due to be paid back on this investment, based on an example investment of £1,000.

| Payment date | Capital repayment | Interest | Total |

|---|---|---|---|

| 31 October 2023 | £83.33 | £35.60 | £118.93 |

| 30 April 2024 | £83.33 | £35.60 | £118.93 |

| 31 October 2024 | £83.33 | £35.60 | £118.93 |

| 30 April 2025 | £83.33 | £35.60 | £118.93 |

| 31 October 2025 | £83.33 | £35.60 | £118.93 |

| 30 April 2026 | £83.33 | £35.60 | £118.93 |

| 30 October 2026 | £83.33 | £35.60 | £118.93 |

| 30 April 2027 | £83.33 | £35.60 | £118.93 |

| 29 October 2027 | £83.33 | £35.60 | £118.93 |

| 28 April 2028 | £83.33 | £35.60 | £118.93 |

| 31 October 2028 | £83.33 | £35.60 | £118.93 |

| 30 April 2029 | £83.37 | £35.60 | £118.97 |

| Total | £1,000.00 | £427.20 | £1,427.20 |