What does the company do?

Liverpool Community Homes plc is a project company setup by Octevo Housing Solutions Limited (“Octevo”) to finance and build social housing.

Octevo, 100% shareholder of Liverpool Community Homes, was set up in 2016 to identify and develop affordable housing using a business model designed to address the core procurement and funding barriers faced by a number of registered social landlords and some local authorities. Rather than requiring them to take on and fund the predevelopment, planning and construction risks and costs, Octevo would take on these costs and build and own the properties in return for a long term lease that should secure long term rental revenues for Octevo. This model is designed to allow private funding to increase the amount of small-scale, quality affordable housing for long-term social use.

Octevo’s objective is to build quality affordable homes that its registered social landlord or local authority partners will lease on a long term basis. In the case of this development, the leases are packaged up with one registered social landlord and will be effective for 50 years. A registered social landlord must abide by the UK’s regulation of social housing, which includes a cap on the amount of rent it can charge for affordable housing. Once the properties are built, the registered social landlord pays a single monthly rental amount in respect of all the homes and will manage the sourcing of, and ongoing relationship with, tenants (usually individuals and families on local authority waiting lists). It will be responsible for the ongoing maintenance of the homes as well as the collection of rent.

Why did the company raise money?

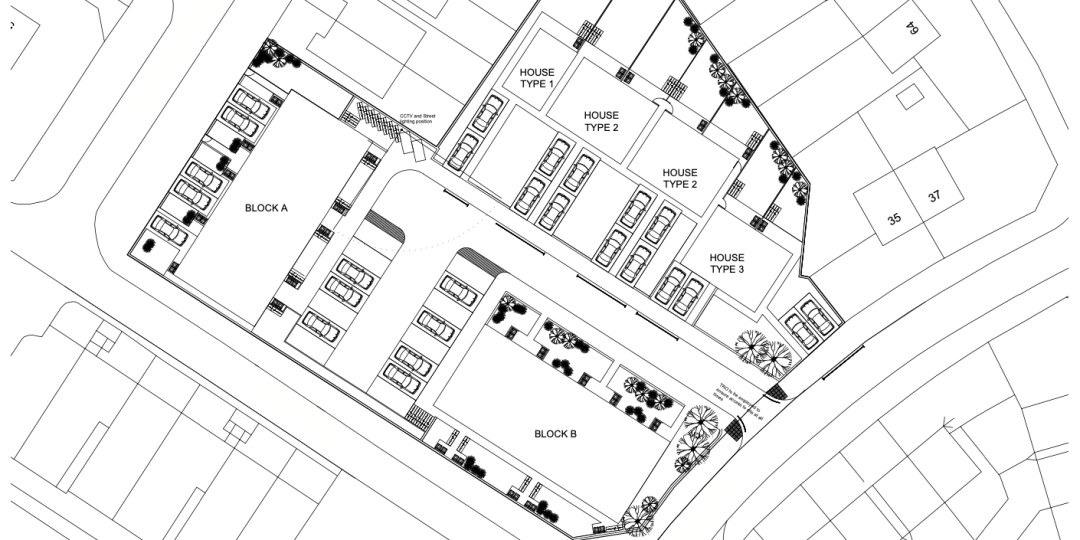

Liverpool Community Homes raised funding to put towards the construction of properties in its proposed Huyton development, situated in the Liverpool district of Knowsley. The development plan consists of 1 detached and 6 semi-detached 2-bed houses for supported living and 20 1-bed flats for affordable living.

How does the company expect to repay the investment?

The level of affordable rents is regulated by the government and increases are linked to inflation (Consumer Price Index). This way of setting rent is designed to protect the affordability of the homes. Since the rent on these affordable homes is the responsibility of the registered social landlord and in some cases may also be guaranteed by the local authority, the income stream is relatively assured. This predictable, long term, inflation linked income stream is attractive to certain institutions, like pension funds, as it can match their liabilities over time.

Octevo’s model to repay investors is therefore to look to sell the rental income from the properties developed by Liverpool Community Homes (either on its own, or packaged with the rental income from other properties being developed) to a large investor. In exchange for an upfront lump sum, the ‘new’ investor receives the rights to the rental income after costs for the remainder of the life of the lease. This upfront sum would be used to repay investors.

If the company is unable to sell the rental income, the company may instead look to sell the homes themselves with the funds from the sale used to repay investors.

In the event that Liverpool Community Homes, the issuer of the investment, is unable to make the payments of interest or capital repayment due to investors, Octevo Housing Solutions (as the parent company of the group) is obligated to make the payments itself.

How is the company making an impact?

The UK has a shortage of suitable housing and in particular, a shortage of affordable housing available to people on social housing waiting lists. Octevo’s business model is designed to remove the barriers that are constraining registered social landlords and local authorities from delivering the number of new homes needed, and rapidly scale the the access to affordable, and high quality, homes.

In addition, for the properties developed as part of the Liverpool Community Homes project, Octevo has identified a number of measures to significantly reduce the net energy demand of the homes without prohibitive cost which will translate to valuable savings in energy bills for the new tenants. These include ground source heat pumps, solar panels, insulation, glazing and LED lighting.

Key terms

Interest is paid every 6 months with the capital repaid as a lump sum on the maturity date.

This investment has first ranking security over all of the assets of Liverpool Community Homes under a package of security documents including:

- a security agreement (including fixed charges and a floating charge) over all of the assets of Liverpool Community Homes

- a share charge over the shares of Liverpool Community Homes

- a security assignment of contractual rights granted by Octevo over certain documents related to the construction contracts for the building of the homes (for example the architects)

Liverpool Community Homes plc has issued another debenture (Debenture 1) which funded the construction of the Northwood property development nearby. Together this results in a larger and more diversified portfolio of properties held by the company. Both debentures are on substantially the same terms. A priority arrangement has been set up such that: the debenture holders that funded the Huyton development will not benefit from the security over the Northwood development assets; and vice versa, the debenture holders that fund this Northwood development will not benefit from the security over the Huyton development assets. Any monies from the enforcement of security over all other assets of Liverpool Community Homes plc (as well as its shares) will be shared on a pari passu basis (ie. proportionally) between holders of both sets of debentures.

The company can choose to repay the investment at any point from and including 1 September 2022, subject to paying an early redemption fee equal to half of the interest that would have been due between the early repayment date and 28 February 2023.

See the Debenture Deed for details of all circumstances in which the option for early repayment may be exercised.Documents

Payment schedule

This table gives a breakdown of what is due to be paid back on this investment, based on an example investment of £1,000.

| Payment date | Capital repayment | Interest | Total |

|---|---|---|---|

| 1 March 2021 | £0.00 | £39.67 | £39.67 |

| 31 August 2021 | £0.00 | £40.32 | £40.32 |

| 28 February 2022 | £0.00 | £39.67 | £39.67 |

| 31 August 2022 | £0.00 | £40.32 | £40.32 |

| 28 February 2023 | £1,000.00 | £39.67 | £1,039.67 |

| Total | £1,000.00 | £199.65 | £1,199.65 |