Developing new energy storage capacity for a zero carbon electricity network

ILI Energy Storage supported the development of a pipeline of pumped storage hydro sites and lithium-ion battery storage projects in Scotland. Energy storage technologies are an important complimentary requirement as we look to balance energy supply and demand and increase grid stability as we increase the number of renewable energy sources and move to a green grid.

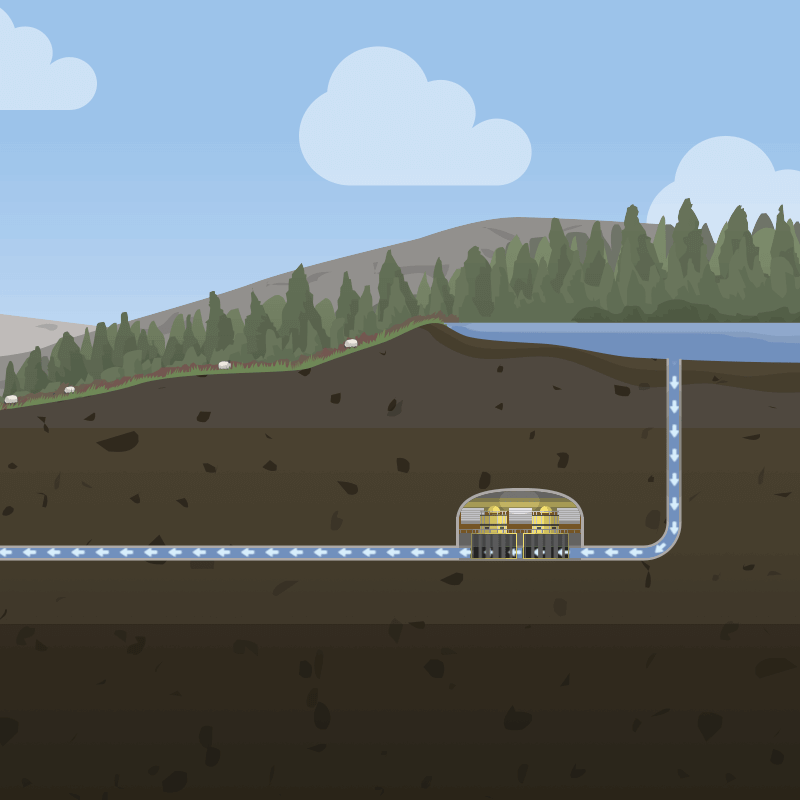

Pumped storage hydro is a large-scale energy storage technology which is generally used to provide additional electricity generation at short notice in times of high grid demand. Water is released and flows downhill to drive turbines; the water is pumped back uphill again when demand is lower (and electricity prices are lower) to repeat the cycle. As we move towards a green grid the role of storage in balancing supply and demand becomes increasingly important, and pumped storage hydro is the most established storage technology we have.

Intelligent Land originally raised investment on Abundance through ILI Pump Storage (a sister company to ILI Energy Storage) in 2017. This was the second investment from experienced renewable energy developer Intelligent Land Investments Group PLC (Intelligent Land). The investment supported the business as it worked to achieve planning consent for new pumped storage hydro projects in Scotland. Alongside pumped storage hydro projects, Intelligent Land has also been advancing the development of several battery storage sites. The characteristics of battery storage complement pumped storage hydro well, as does development of the projects which are much smaller and therefore more straightforward to consent.

This investment was fully repaid on 29 December 2022.

Key terms

Documents

Payment schedule

This table gives a breakdown of what was paid back on this investment, based on an example investment of £1,000.

| Payment date | Capital repayment | Interest | Total |

|---|---|---|---|

| 30 June 2020 | £0.00 | £75.06 | £75.06 |

| 31 December 2020 | £0.00 | £50.41 | £50.41 |

| 30 June 2021 | £0.00 | £49.58 | £49.58 |

| 31 December 2021 | £0.00 | £50.41 | £50.41 |

| 30 June 2022 | £0.00 | £49.58 | £49.58 |

| 29 December 2022 | £1,000.00 | £50.41 | £1,050.41 |

| Total | £1,000.00 | £325.45 | £1,325.45 |