About Glasgow City Council

Glasgow City Council is committed to making Glasgow one of the greenest cities in Europe, creating a healthier and more climate resilient city for its citizens to enjoy.

The city is working towards an ambitious goal of being Net Zero Carbon by 2030 through the delivery of the Glasgow Climate Plan which outlines the city's vision and sets out a course of action.

The council wants this transition to benefit all communities in the city, improving both quality of life and climate resilience.

This investment programme allows residents to get involved to support the council's ambitions.

How is the council using the money raised?

Glasgow City Council will use the money raised to fund interventions in the city to help fight against the present and future impacts of climate change.

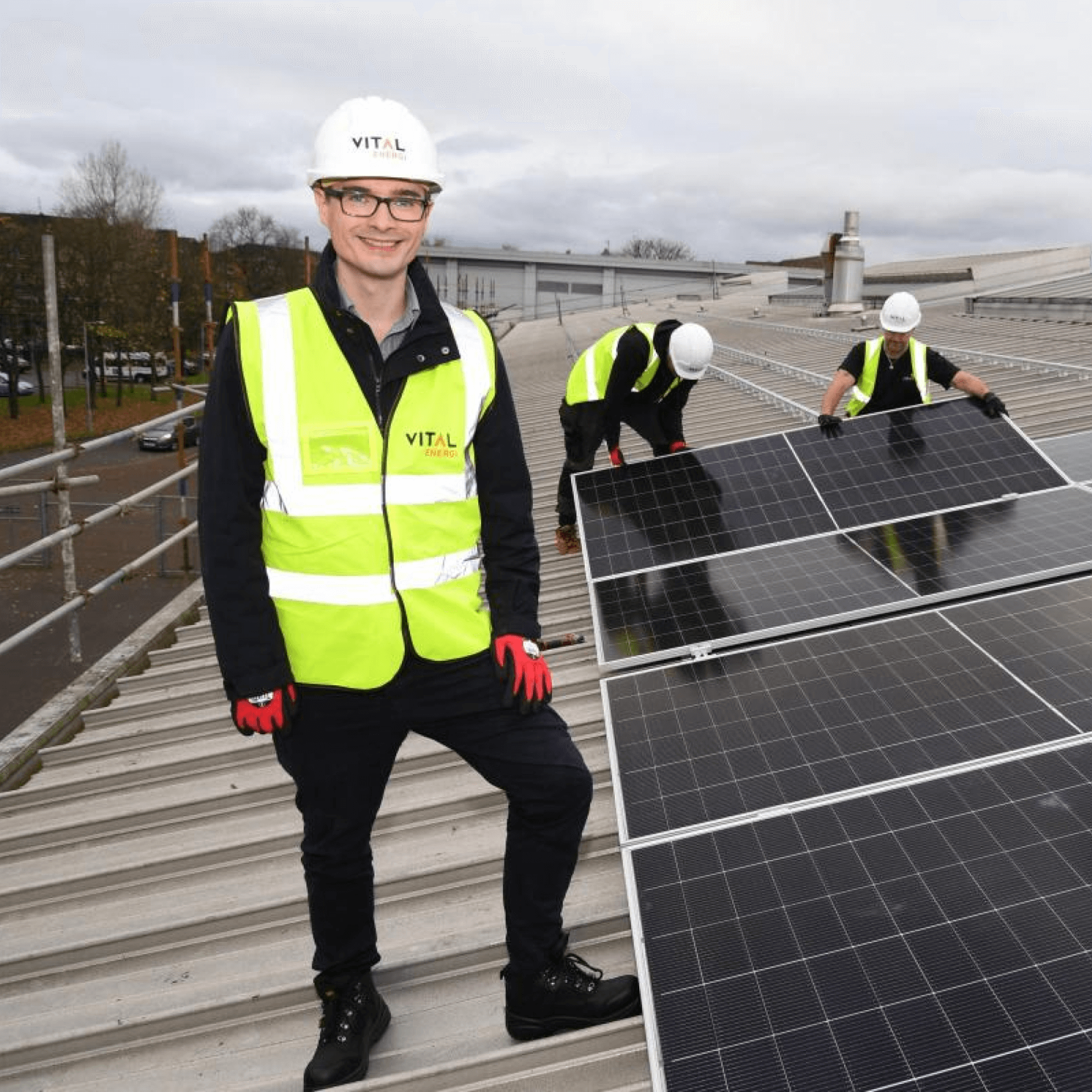

This will include sustainable energy projects, supporting the installation of solar panels across a number of council sites to reduce annual energy costs.

All investments from Glasgow City Council are compliant with the Green Loan Principles - internationally recognised standards that are also used by the UK Government for its green investments products. They require that the money invested can only be used to fund eligible green projects.

Key terms

Funding Eligible Green Projects under the Green Finance Framework, with an expected focus on Green Energy and Clean Transportation.

Documents

Payment schedule

Find out how much you could earn using the calculator below.