What does the company do?

GB Lights is a company set up by two of the shareholders of Global Berry Limited, a company that owns and operates glasshouse farms to grow fruit throughout the year in the UK. Although GB Lights is not a subsidiary company, its commercial success is closely affected by the overall success of the Global Berry group.

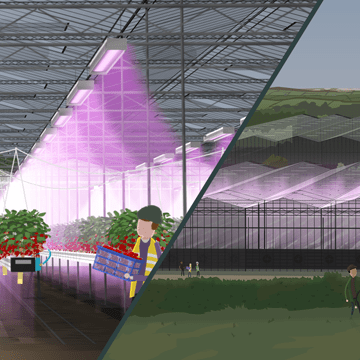

The purpose of GB Lights as a company is to install and maintain energy efficient LED lighting at Global Berry’s glasshouse sites and over time it may also provide the same service to other glasshouse operators. The company has installed LED lighting within 3 hectares of Global Berry’s existing 11-hectare farm in Bradon, Somerset.

By installing the efficient LED lighting, Global Berry can extend the growing period for its strawberries throughout the year at that site. The LED lights give the light levels needed for particular varieties of strawberries to flower through the winter until early spring. The lights are not run all the time though, with a control program continually monitoring the natural light levels and supplementing it only as required so that energy use is minimised.

GB Lights is paid a service fee for the provision of the lights and their ongoing maintenance to ensure they provide the expected light levels.

Why did the company raise money?

The funds raised through this investment were used to buy and install new LED lights within 3 hectares of Global Berry’s 11-hectare farm in Bradon, Somerset.

How does the company expect to repay the investment?

GB Lights expects to make the interest and capital repayments over the life of the investment through its own revenues from the ongoing provision of lighting to Global Berry.

How is the company making an impact?

The food industry accounts for a significant proportion of global greenhouse gas emissions so it is a key sector in the climate challenge.

Global Berry’s advanced glasshouses allow the company to grow strawberries in the UK over a longer growing season. The installation of LED lighting, as well as increasing yields, further extends the growing season over the winter months which means the strawberries grown by Global Berry can offset strawberries which would otherwise be imported - reducing food miles while also allowing the company to focus more on flavour and quality rather than longer shelf life.

The extension of the growing period has the added positive impact by providing the opportunity to offer more workers permanent contracts and reduce the number of staff required during periods of peak production because fruit will be picked throughout the year instead of just for 6 months. It will allow the farm to employ seasonal workers for longer periods during the year

Global Berry uses renewable energy as far as possible, with biomass boilers installed for heat and control software so that the strawberry plants are only watered and heating or lighting triggered when the climate requires it. This also reduces its exposure to fluctuating fossil fuel prices.

Key terms

Interest and capital are paid every 6 months throughout the length of the investment.

This investment has first ranking security over all of the assets of GB Lights Plc under a package of security documents including:

- security agreement containing, amongst other things, fixed and floating charge over all the assets of GB Lights (including the LED lights themselves) and assignments by way of security of the 7-year warranty for the lights and 5-year warranty for the lighting control system from GE Current

- share security over all the issued share capital of GB Lights

The company can choose to repay the Debentures at any point from 1 November 2023 onwards subject to paying an early redemption fee and giving 20 business days's notice. The early redemption fee is equal to the following six months's interest payment.

The company can also make an early repayment in certain circumstances, such as a change of control of the company (for example, if some or all of the company was sold to a new owner) or a regulatory/tax requirement.

See the Debenture Deed for details of all circumstances in which the option for early repayment may be exercised.Documents

Payment schedule

This table gives a breakdown of what is due to be paid back on this investment, based on an example investment of £1,000.

| Payment date | Capital repayment | Interest | Total |

|---|---|---|---|

| 29 April 2022 | £42.27 | £50.30 | £92.57 |

| 31 October 2022 | £44.38 | £48.28 | £92.66 |

| 28 April 2023 | £46.60 | £45.29 | £91.89 |

| 31 October 2023 | £48.93 | £43.69 | £92.62 |

| 30 April 2024 | £51.38 | £40.77 | £92.15 |

| 31 October 2024 | £53.95 | £38.63 | £92.58 |

| 30 April 2025 | £56.65 | £35.33 | £91.98 |

| 31 October 2025 | £59.48 | £33.06 | £92.54 |

| 30 April 2026 | £62.45 | £29.57 | £92.02 |

| 30 October 2026 | £65.57 | £26.91 | £92.48 |

| 30 April 2027 | £68.85 | £23.22 | £92.07 |

| 29 October 2027 | £72.30 | £20.13 | £92.43 |

| 28 April 2028 | £75.91 | £16.31 | £92.22 |

| 31 October 2028 | £79.71 | £12.66 | £92.37 |

| 30 April 2029 | £83.69 | £8.50 | £92.19 |

| 31 October 2029 | £87.88 | £4.42 | £92.30 |

| Total | £1,000.00 | £477.07 | £1,477.07 |