What does the company do?

Edinburgh-based company Celtic Renewables has developed a process for taking low value residual products from other industrial processes and convert them into a range of useful, higher value, chemical products which have a number of applications. This can displace chemicals derived from fossil fuels, cut carbon emissions and improve the sustainability of all those industries who could benefit from it. The process is an innovative adaptation of an established method of producing Acetone-Butanol-Ethanol (ABE) by way of fermentation. The initial focus is using the residues from the whisky and potato industries but the process can also use a variety of other feedstocks such as brewers’ grains, recovered paper, bakery residues and straw.

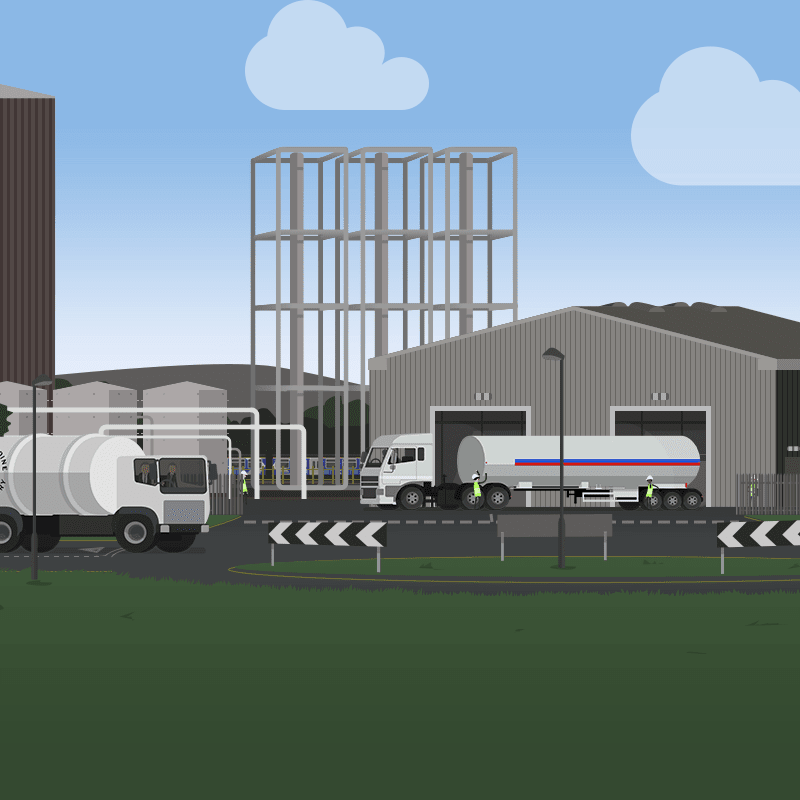

Working closely with the whisky industry and the Scottish Government, the company has proven the process, secured patents, and with investment from the Abundance community, has constructed its first commercial production plant called Caledon Green in Grangemouth. This first plant aims to act as a demonstrator and test site for other low value potential feedstocks such as waste paper and bakery residues. The plant aims to demonstrate the technology and process at commercial scale for use on a larger scale across Scotland and other key whisky producing countries.

Why did the company raise money?

The company raised money on Abundance as part of a wider funding package to provide the funding required to construct and commission its first commercial plant in Grangemouth.

How is the company making an impact?

Celtic Renewables converts low value residues from a variety of industries, such as draff (solid residue from malted barley) and pot ale (liquid residue) from the whisky industry, into higher-value chemicals that can be be used in a variety of everyday products. This displaces chemicals usually derived from fossil fuels and helps to cut carbon emissions from the industries which require these chemicals.

Investment history

Extension 2020

A grant awarded to Celtic Renewables, which was due to cover a significant proportion of the construction costs for the Grangemouth plant, was unexpectedly withdrawn in late 2018. This meant the company temporarily suspended all construction work until replacement funding could be secured. By the end of March 2020, the company had secured the required replacement funding to restart work on the Grangemouth plant, including an additional £726,000 from existing Debenture holders. To give Celtic Renewables Grangemouth more time to secure the funding and complete the Grangemouth plant, the maturity date of the investment was extended to 30 June 2022.

Restructuring 2022

Celtic Renewables Grangemouth was unable to make the repayment of capital and interest payment that was due on the maturity date of 30 June 2022. The company therefore made a restructuring proposal to investors which was voted on and agreed with investors in July 2022. The restructuring meant that investors' capital was converted into shares in Celtic Renewables Limited (the parent company of Celtic Renewables Grangemouth plc) with the interest owed to investors becoming an obligation of Celtic Renewables Limited with a new payment date of 31 December 2024.

This investment represents the shares held in Celtic Renewables Limited.

Interest extension 2024

In December 2024, the company requested an extension for the interest payment to give the company more time to complete its Series B funding round. This proposal was accepted by the required threshold of investors and so the interest payment was due to be paid by 30 September 2025, but could be paid earlier. The outstanding interest amount accrues interest at 9% from 1 January 2025.

Interest extension 2025

In October 2025, the company requested a further extension for the interest payment to give the company more time to raise the funding the needed to make the payment. This proposal was accepted by the required threshold of investors and so the interest payment is now due to be paid by 30 September 2027, but can be paid earlier. The outstanding interest amount accrues interest at 9% from 1 January 2025. As part of the accepted proposal, investors will also receive warrants equal to 10% of their existing shareholding.

Shareholding

In 2022, as part of the restructuring proposal agreed with investors, investors' capital was converted into shares in Celtic Renewables Limited (the parent company of Celtic Renewables Grangemouth plc) with the interest owed to investors becoming an obligation of Celtic Renewables Limited with a new payment date of 31 December 2024.

This investment represents the shares held in Celtic Renewables Limited.

Documents

Shareholding

Your shareholding in Celtic Renewables Limited is an equity holding, which means there are no fixed repayment dates or interest payments. Your shareholding gives you a right to a share of any future dividends paid out by Celtic Renewables Limited.

In the future there may be options to sell your shares, for example if the business is sold in part or in full, which would give you the opportunity to exit your shares and receive a retun.