What does the company do?

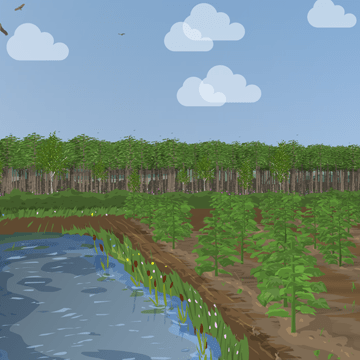

Carbon Plantations is helping farmers convert previously intensively farmed agricultural land into hardwood forestry plantations. The company is taking a new approach by planting fast-growing Phoenix One® hardwood trees, a non-invasive variety of Paulownia, supplied by WeGrow CropTec GmbH, who have been producing varieties of Paulownia successfully since 2009.

The company typically leases land from a landowner under a long term lease and then manages the process of planting the trees, managing the woodland and then harvesting the trees when ready. The planting areas are chosen and refined through significant Environmental Impact Assessment work and stakeholder engagement.

The company's income is derived from the sale of timber as well as the sale of carbon credits. The timber produced is strong and lightweight, providing a source of high value, sustainable UK-grown timber that can be used in place of slow-growing species such as oak, with applications in light construction and furniture making. The woodland project also qualifies for carbon credit payments under the Woodland Carbon Guarantee Scheme run by the Forestry Commission, which is intended to promote the planting of new woodlands in England.

Why did the company raise money?

This was the Carbon Plantations' group third investment on Abundance. The funding was put towards their first site in Norfolk at Hockwold Fen, part of a planned four sites across Norfolk which could total 264ha, all on former intensively farmed land.

How does the company expect to repay the investment?

Carbon Plantations expects to repay investors either through the revenue earned from timber sales and carbon credits, or refinancing the debt by raising funding from other sources.

How is the company making an impact?

Carbon Plantations aims to provide the wood needed to build and live sustainably, while helping to regenerate our soils and boost biodiversity. Trees can help mitigate climate change by reducing the amount of greenhouse gases in the atmosphere. They do this by absorbing carbon dioxide through photosynthesis, using the carbon to produce sugars for tree growth and releasing the oxygen back into the air. As trees grow, they store carbon in their leaves, twigs and trunk, roots and in the soil around them. This capture and storage of carbon in soils and trees is a natural way of sequestering carbon. The sustainable timber will be sold, enabling the carbon to be locked up not only during the tree's growth but during the time that it is used for hardwood applications such as in furniture or construction materials.

The Phoenix One® hardwood trees are fast growing — up to 4m a year — which means they absorb carbon dioxide up to seven times faster than newly planted native woodland and will be sustainably harvested by coppicing. As well as absorbing carbon, this project also offers a range of other environmental and biodiversity benefits. As deciduous trees they will allow an understorey of biodiverse plants to develop supporting insects (including bees and other pollinators) and other wildlife. And because they are planted on formerly intensively cultivated land, the trees will help regenerate and improve the soil structure. 15% of the land is planted with new native woodland, with 14% open grassland sown with a nectar and wild bird-friendly seed mix to encourage biodiversity.

Key terms

Some interest is paid every 6 months over the life of the investment with capital repaid as a lump sum at maturity.

Every 6 months you will be paid 50% of your interest with the other 50% being rolled up and only paid at maturity at the same time as the capital repayment. The unpaid rolled up interest will continue to earn interest at the same rate. The first interest period is a shorter 3 month period with the last period being 9 months.

This investment holds first ranking security over all of the assets of Carbon Plantations 2 Limited under a package of security documents including:

- security agreements by way of fixed and floating charge over all of the assets of Carbon Plantations 2 Limited (trading as Carbon Plantations Norfolk 2023)

- share security over all the issued share capital of Carbon Plantations 2 Limited (trading as Carbon Plantations Norfolk 2023)

- various direct agreements which provide the Security Trustee with certain rights such as being notified of a termination event or, in some cases, stepping into our shoes upon a termination event under certain project contracts (such as the leases and operation & management agreement).

The company has the option to repay the investment at any point from 1 April 2025 onwards subject to paying an early redemption fee (equivalent to the next 6 months's interest payment) and by giving 20 days notice.

The company can also make an early repayment in certain circumstances, such as a change of control of the company (for example, if some or all of the company was sold to a new owner) or a regulatory/tax requirement.

See the Debenture Deed for details of all circumstances in which the option for early repayment may be exercised.Documents

Payment schedule

This table gives a breakdown of what is due to be paid back on this investment, based on an example investment of £1,000.

| Payment date | Capital repayment | Interest | Total |

|---|---|---|---|

| 29 September 2023 | £0.00 | £10.08 | £10.08 |

| 28 March 2024 | £0.00 | £20.25 | £20.25 |

| 30 September 2024 | £0.00 | £20.66 | £20.66 |

| 31 March 2025 | £0.00 | £20.96 | £20.96 |

| 30 September 2025 | £0.00 | £21.49 | £21.49 |

| 31 March 2026 | £0.00 | £21.80 | £21.80 |

| 30 September 2026 | £0.00 | £22.36 | £22.36 |

| 31 March 2027 | £0.00 | £22.69 | £22.69 |

| 30 September 2027 | £0.00 | £23.27 | £23.27 |

| 31 March 2028 | £0.00 | £23.73 | £23.73 |

| 29 September 2028 | £0.00 | £24.21 | £24.21 |

| 30 March 2029 | £0.00 | £24.56 | £24.56 |

| 28 September 2029 | £0.00 | £25.19 | £25.19 |

| 29 March 2030 | £0.00 | £25.55 | £25.55 |

| 30 September 2030 | £0.00 | £26.20 | £26.20 |

| 31 March 2031 | £0.00 | £26.58 | £26.58 |

| 30 September 2031 | £0.00 | £27.26 | £27.26 |

| 31 March 2032 | £0.00 | £27.81 | £27.81 |

| 30 September 2032 | £0.00 | £28.37 | £28.37 |

| 30 June 2033 | £1,000.00 | £529.46 | £1,529.46 |

| Total | £1,000.00 | £972.48 | £1,972.48 |